News Backgrounder

Etihad board aborts loss-making strategy

The Etihad Aviation Group strategy of building a network through a string of airline investments worldwide continues to fall apart as yet another of its joint ventures, airberlin, enters bankruptcy proceedings.

September 1st 2017

It’s not the best of times for Abu Dhabi’s Etihad Airways and its parent, the Etihad Aviation Group. In late July, the airline reported a massive $1.87 billion net loss for 2016. Read More » That bad news was followed last month by the announcement that one of Etihad’s European equity partners, German low-cost carrier, airberlin, was bankrup.

Another member of the Etihad airline partnership, Italian flag carrier, Alitalia, went into administration in May after unions refused to support the airline’s latest restructuring plan.

|

And it could get worse for the Abu Dhabi airline group. When he announced the 2016 loss, Etihad Airways’ interim group CEO, Ray Gammell, said the “ever-evolving competitive environment is likely to impact overall performance in 2017”.

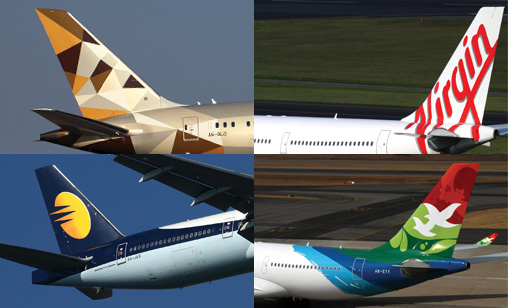

Since Gammell formally succeeded James Hogan on July 1, it has become increasingly clear the airline’s owners, the government of Abu Dhabi, are far from happy with the returns on their investments, or lack thereof, from its partnerships in Alitalia, airberlin, Virgin Australia, Jet Airways and Air Seychelles. Etihad’s financial exposure to Alitalia and airberlin alone is reported to be more than $4.5 billion.

The 2016 losses compare with a $103 million profit for the carrier a year earlier. Etihad attributed the loss to one off impairment charges, fuel hedging losses, an $808 million charge on certain assets and exposure to equity partners, mainly airberlin and Alitalia.

When the German LCC went under last month Etihad said it would withdraw financial support from the struggling carrier. “This development is extremely disappointing for all parties, especially as Etihad has provided extensive support to airberlin for its liquidity challenges and restructuring efforts over the past six years,” said Etihad.

In April this year, the Etihad Aviation Group said it had provided “250 million euros ($295 million) of additional funding” to airberlin as well as supporting the airline as it searched for strategic options for the business.

“However, airberlin has deteriorated at an unprecedented pace, preventing it from overcoming its significant challenges and also from implementing alternative strategic solutions,” an Etihad Aviation Group statement said.

That was an understatement. The beleaguered German carrier has accumulated more than $3 billion in losses in the last six years and has net debts of $1.4 billion. The carrier and Germany’s economic ministry said in separate statements that Lufthansa and another unidentified airline are “far advanced” with plans for a partial rescue.

Most analysts believe Etihad’s grand plan to rule the world’s airways is in deep trouble. Under former group CEO Hogan, the airline group embarked on an equity acquisition spree that saw it acquire shareholdings in Alitalia (49%), airberlin (29.2%), Air Serbia (49%), India’s Jet Airways (24%),Virgin Australia (21.8%) Air Seychelles (40%) and Austria’s Niki (49.8%) as well as 33% of Swiss-based Darwin Airways. Etihad sold its interest in Darwin Airways, which was rebranded as Etihad Regional, in July.

Hogan’s strategy has allowed Etihad to penetrate deeply into markets in Europe, Australia and India. Where partners could co-operate, the in-company alliance of airlines also brought significant savings to the group in pilot training, aircraft maintenance and fleet acquisition. But some of the airline investments were high risk. Alitalia, for example, had long been a financial and service basket case.

Some airlines in the group have performed better than airberlin and Alitalia. A re-launched Air Serbia is a solid feeder for the Etihad network and the investment in Jet Airways helped Etihad enter the potentially lucrative Indian market. Virgin Australia has become a viable competitor for Qantas, although it is still reporting losses and has yet to give Etihad’s shareholders a return on their investment.

“A culmination of factors contributed to the disappointing results for 2016. The board and executive team have been working since last year to address the issues and challenges through a comprehensive strategic review aimed at driving improved performance across the group, which includes a full review of our airline equity partnership strategy,” said the chairman of the Etihad Aviation Group, Mohammad Al Mazroui.

At home base, Etihad Airways CEO, Peter Baumgartner, said his airline faced the same issues as the industry in general. “Overcapacity, declining market sizes on key routes and changing consumer behaviour are combining with a weak global economy that is affecting spending appetite,” he said.