Main Story

Engine makers address delivery delays

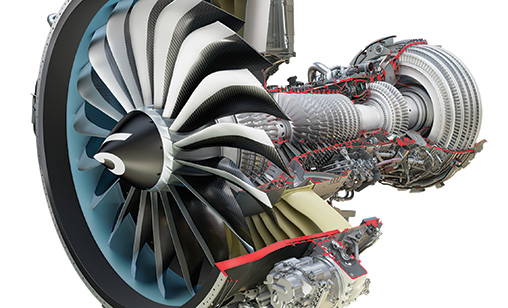

The last two years have been tortuous for several airlines operating fleets of new generation engines. Propulsion systems design problems caused inflight shutdowns, aircraft fleet groundings and costly adjustments to airline schedules. Is there an end in sight?

October 1st 2018

It was the last thing Rolls-Royce wanted to hear. Read More » Last month, the crew of an Iberia A350 flight from New York to Madrid had to shut down one of its Trent XWB engines and make an emergency landing at Boston’s Logan Airport. No-one was injured but the incident sparked the biggest one day drop in the share price of the British propulsion manufacturer in more than a year.

The market reaction reflected investors’ fears that the newest generation engine might have problems similar to Trent 1000 engines. At the time, Rolls-Royce was at pains to point out the XWB was based on a different architecture and is “categorically” unaffected by the same flaws as the Trent 1000”.

|

The cause of the Iberia event is being investigated. A Rolls-Royce statement said: “We are aware of the issue and will be working closely with the airline to support it. The Trent XWB has enjoyed the smoothest entry into service of any wide body engine. We continue to see the engine achieving market-leading levels of reliability.”

The Trent 1000 is the engine of choice for B787 Dreamliner operators. Surprisingly, most of them have been very patient with their engine supplier and often have publicly praised the commitment of its engineers to get the engines flying as soon as possible. But the schedules of B787 carriers continue to need adjustment as more Rolls engines are identified for unscheduled maintenance checks and repairs.

A recent example of this problem was Air New Zealand’s announcement that it would be terminate its seasonal Auckland-Ho Chi Minh City B787-9 this month: The reason? The “ongoing challenges” it is experiencing “as a result of the issues affecting the Rolls-Royce engines” on its Dreamliner fleet.

The carrier has three of its 12 B787-9s on the ground at its Auckland headquarters because of endurance issues affecting the engines and the decision of regulators to place limits on the length of B787 sectors. Airlines have had schedule and network issues because the compressor in the Trent 1000 package C engines is not lasting as long as expected.

Previously unscheduled inspections have been required for the effected engine categories that have forced Rolls-Royce airline customers to take much needed aircraft out of service while the checks are done. Air New Zealand has had to lease in less fuel efficient aircraft, at significant cost, to deliver scheduled services to passengers.

Boeing and Airbus have dozens of single-aisle jets parked at their facilities awaiting engines. Last month, 53 undelivered jets were standing idle at Boeing Commercial Airplane’s Renton facility in Seattle compared from just over 40 a month earlier.

Thirty eight of the airplanes were the new B737 MAX model and 14 were without the new LEAP engines manufactured by U.S./Franco joint venture company, CFM International.

At its plants in Toulouse and Hamburg, Airbus has A320neo aircraft awaiting installation of Pratt & Whitney’s geared turbofan (GTF) engines. As with the B787, customers operating the A320neo are experiencing GTF issues that have grounded delivered aircraft because spare engines are in short supply.

In India last month, low-cost carrier, IndiGo, removed one more A320neo equipped with Pratt & Whitney engines from its operating fleet after oil chips were found in the engine.

|

There are 60 A320neo flying with GFT engines in India: 41 with IndiGo and 19 with GoAir. There have been numerous groundings in the last year, including an Indigo A320neo that had flown less than 50 hours since delivery.

Fixes for the problems are in place, but new malfunctions continue to crop up. It was recently reported that the U.S.-based engine manufacturer was investigating incidences of excessive engine vibration in A320neo GTF engines. Pilots have received alerts of high vibration levels in flight. The Federal Aviation Administration (FAA) is studying the problem.

Is there an end in sight to what many in the industry described as an engine crisis? The answer engine and aircraft manufacturers told Orient Aviation is yes. Boeing and Airbus said their delivery schedules would be back on track by year end and engine manufacturers were confident its design problems were being solved.

A Pratt & Whitney spokesman told Orient Aviation last month that its GTF engine is on three airframe platforms, with this year’s inaugural of Norway’s Wideroe’s E2 joining the A220 (formerly known as the Bombardier C Series) and the A320neo.

“All three GTF variants are proving their worth to our airline customers by driving significant fuel savings [at airlines] of more than 40 million gallons of fuel since the GTFengine entered service in 2016.

The email reply added that as the newest technology and architecture was introduced in jet propulsion, Pratt & Whitney had worked through some entry into service issues and focused on supporting customers.

“Our industrial ramp up is on track. We are meeting our delivery commitment to airframers. It is interesting to note that while it took 30 years to produce and deliver 7,000 V2500 engines, it will take a third of that time to meet demand for the GTF.” Pratt & Whitney has received orders for more than 2,000 GFT systems in the last 12 months, it said.

At Rolls-Royce, its engineers are completing the development of a suite of modifications to resolve the reliability issues on large numbers of Trent 1000-powered B787s. It is confident the final piece of the package will be cleared for introduction into airline fleets in the next few months. The improvements are expected to allow airlines that have bought earlier-standard Package B and C engines to resume long-range flights with no limits and relieve the carriers of the extra inspection burdens that have been required since the engine malfunctions were identified in 2016.

Airbus declined to provide Orient Aviation with the specific number of its aircraft that were awaiting engine installation. “The engine manufacturers are working hard to meet their commitments. The number of parked A320neo Family aircraft awaiting engines is going down each month. We are still target to deliver around 800 aircraft (all Airbus aircraft types, excluding A220 Family) this year,” an Airbus Commercial Aircraft spokesman said.

|

A Boeing Commercial Airplanes told Orient Aviation it was “working closely with suppliers, both Spirit and CFM as they track toward recovery, as well as our customers. Our team has been mitigating supplier delays and our factory continues to build 52 airplanes a month.” Spirit supplies fuselage parts for Boeing aircraft.

At CFM, the engine problems centre around a new high-pressure turbine blade. Precision Castparts Corporation (a Warren Buffet company) and rival Arconic Inc. have been struggling to manufacture the airfoils and a handful of other parts for the upgraded engine.

Production pressure is so intense that Precision Castparts, the leading source of the blades cast from molten nickel alloys, has informed customers in writing that it cannot accept new orders.

Boeing has dedicated additional resources to its Renton site to ensure timely deliveries to customers. “We have about 10,000 people across three shifts at the Renton site. Over the three shifts at Renton, about 600 Boeing employees from other Puget Sound locations are temporarily working in Renton as we take steps to expedite customer deliveries,” Boeing said.

“Our workforce strategy allows us to redeploy employees to the 737 program without interrupting our other programs. Our team made good progress in August and we’re focused on fully recovering the delivery schedule by the end of the year.”

Boeing delivered 48 B737s in August, well up on the 29 narrow-bodies it sent to customers a month earlier. The July delivery numbers were one of the lowest monthly tallies at the manufacturers in years.

At press time, CFM told Orient Aviation in an email reply that “it continues to work closely with Airbus and Boeing to mitigate limited manufacturing issues and keep engine delivery disruptions to a minimum”.

“The company has experienced some production delays and is currently a few weeks late to airframer request. However, CFM has a line of sight to close the gap by year-end. Supported by the redundant sourcing strategy on LEAP production parts, CFM is working to accelerate the flow of parts and engines to minimize the impact on customers and meet production commitments,” the manufacturer said.

CFM said the plan included the addition of surge production capacity, acceleration of capital expenditure and employing more technicians.