News Backgrounder

More staff cuts on horizon at several Asia-Pacific carriers

November 1st 2020

Fleet downsizing and job cuts have become the order of the day for some of the Asia-Pacific’s biggest airlines as their operations and finances continue to be rocked by a coronavirus pandemic that refuses to abate. Read More »

A little more than a month after Singapore Airlines announced it was reducing its workforce by 4,300 in the face of the “debilitating impact” of the pandemic, Hong Kong’s Cathay Pacific Group disclosed it would make almost 6,000 staff redundant and close its regional carrier, Cathay Dragon.

|

|

|

In Japan, both major carriers are reporting record losses. Japan Airlines (JAL) is projecting a net loss of more than US$1.9 billion for its current fiscal year. It is turning unprofitable for the first time since relisting on the Tokyo stock market in 2012 after its 2010 bankruptcy.

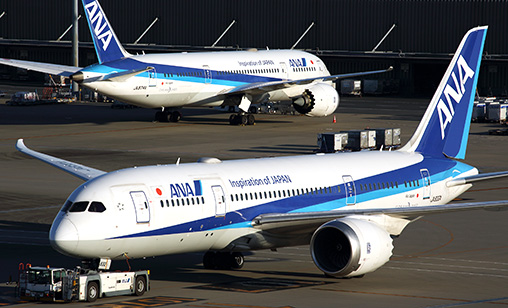

Rival All Nippon Airways (ANA) said it expected to report a massive $4.8 billion deficit for the year. At press time, the airline’s parent company, ANA HOLDINGS INC. (ANA HD), unveiled its “Transformative Measures to a New Business Model” to take into account reduced business class travel, robust and increased demand for leisure and visiting friends and relatives (VFR) travel, passenger preference for sustainable flying policies and high standards of automated options that improve hygiene for customers.

The grim statistics of 2020 forcing radical change on some of the most successful carriers in the world come as the International Air Transport Association (IATA) warned airlines will have to reduce operating costs by at least 30% in 2021 to counter a forecast 50% plunge in revenue from pre-COVID-19 levels. The major steps taken by the region’s airlines to reduce costs have not been sufficient, leaving the industry with little choice but to trim their largest expenses, one of which is the cost of labour. That means downsizing staff, which is often extremely difficult in the face of labour unions.

“Airlines have to shell out money for maintenance and repairs as well as leasing aircraft and wages. These costs are much harder to reduce, particularly quickly. That is a key reason they were making massive losses in the second quarter and burning cash,” said IATA’s chief economist, Brian Pearce, last month. There was little indication the first half of next year will be significantly better, he added.

In the face of the crisis and essential to its transformation is ANA’s decision to dispose of 30 B777s, but ANA president and chief executive, Shinya Katanozaka, has ruled out the possibility of receiving additional government support. “We are not expecting it,” he said during a news conference after the company announced its earnings outlook. He also brushed off concerns about the financial standing of ANA and promised a return to profitability in fiscal 2021 with a shift to its new business model.

ANA will receive $3.8 billion in subordinated loans from major banks, including the government-affiliated Development Bank of Japan, to strengthen its financial base.

In addition to ANA and its low-cost subsidiary Peach Aviation, the group will establish a third airline based on its domestic Air Japan unit, and “pursue sustainable growth through transforming the services of the Group’s airlines to cater to a wider range of customer needs in price range and services”. It will target demand for low-cost, medium distance flights to Southeast Asia and Oceania with 737s configured with 300 seats.

JAL reported a net loss of US$1.5 billion for the six months to September 30. It has implemented cost-cutting measures and benefited from a government program launched in late July that subsidizes 35% of domestic travel expenses. JAL said it would take time for international air travel demand to recover as long as strict border controls remain in place amid the coronavirus pandemic.

JAL introduced new accounting standards, starting in the current business year, and is considering raising as much as $2.9 billion in capital to strengthen its financial standing. For JAL, the situation is a matter of déjà vu. After it filed for bankruptcy in 2010, it undertook drastic restructuring measures that reduced its fleet by more than 100 aircraft and eliminated about 16,000 staff from its payroll.