Alliances

Alliances adjusting to new operating reality

More than two decades after they arrived on the aviation scene alliances are facing a shake-up. China Southern Airlines, the region’s largest airline has, as expected, left SkyTeam in favour of a closer relationship with oneworld’s American Airlines. In Doha, Qatar Airways is strongly signaling it will walk away from oneworld in 2019. Chief correspondent, Tom Ballantyne, reports.

December 1st 2018

When China Southern Airlines (CSA), the country’s largest carrier, announced last month it would be pulling out of the SkyTeam alliance on January 1, it was confirmation of rumours that had been circulating in the industry since 2017. Read More »

Within the month, it was the turn of Qatar Airways to churn that same rumour mill. The outspoken group CEO of the airline, Akbar Al Baker, is believed to be ready to extract his carrier from oneworld because of souring relations with two alliance members, American Airlines and the Qantas Group.

|

No-one should be surprised at this turn of events. In the world of global airline alliances, sleeping with the enemy has become par for the course. It is increasingly evident that whatever the benefits of the unions, bilateral co-operation with non-alliance member airlines has become just as important, if not more so, than being in only one club.

In recent years, SkyTeam’s CSA has been closely co-operating with oneworld’s Qantas, which in turn has a serious relationship with non-affiliate, Emirates Airline. Star’s Air New Zealand code-shares with oneworld’s Cathay Pacific Airways. Star’s Singapore Airlines co-operates with SkyTeam’s Air France/KLM as does oneworld’s Qantas.

Oneworld’s American Airlines last year took a $200 million, 2.68% holding in CSA. Star’s Air China owns 30% of oneworld’s Cathay Pacific and oneworld’s Qatar Airways holds another 9.94% of the Hong Kong-based carrier.

In essence, individual airlines are ready to co-operate with any partner that adds value to their businesses whether they are alliance partners or not.

So what’s next? Will CSA join oneworld? Will Qatar join another alliance or return to independence like its fellow Gulf airlines, Emirates and Etihad Airways? Is there any truth in reports Cathay is weighing up resigning from oneworld?

Industry insiders postulate Qantas will strengthen its co-operation with CSA, perhaps with a joint venture that would encourage passengers to switch from Hong Kong to Guangzhou on the way to Europe.

CSA’s departure from SkyTeam was “based on the needs of the company’s development strategy and would better align it with the new trend of cooperation in the global aviation industry,” it said.

“CSA would “explore the possibilities of establishing partnerships with advanced airlines, promote bilateral and multilateral cooperation and provide quality services to passengers around the world”, it said. CSA president, Tan Wangeng, said in a recent Bloomberg Television interview there was potential to deepen ties with American Airlines – and it has.

The Civil Aviation Administration of China (CAAC) has granted CSA approval to establish Xiongan Airlines. It will be based at Beijing Daxing airport and is planned to operate a fleet of A320s on domestic and international routes. Speaking at World Routes 2018 in September, CSA’s Tan said the carrier intends to increase its fleet from 800 to 2,000 aircraft by 2035 as it pursues its dual-hub Guangzhou-Beijing strategy.

At oneworld, Qatar’s unhappiness has long been bubbling below the surface of the carrier’s relationship with some oneworld members. The airline has not confirmed its departure, but Al Baker has said several times on the record that he did not see any point in the airline remaining a member of the oneworld alliance “when other partners see us as a threat”.

He has publicly accused fellow alliance member, Qantas, of failing to act “in the spirit” of the alliance by lobbying against Qatar’s request to operate more flights into Australia. The Doha-based airline flies to Sydney, Melbourne, Canberra, Adelaide and Perth from Doha and has been trying to gain entry to Brisbane.

The request has been stymied by Qantas, which has accused Qatar of dumping capacity and being “uncommercial and uncompetitive” by selling tickets at low prices. It pointed to research by a U.S. lobby group that claimed Qatar Airways has received more than US$17 billion in state aid and interest free loans.

“This distorts markets and threatens the sustainable operation of international carriers to Australia,” said Qantas. The airline’s CEO, Alan Joyce, said “nobody should be in an alliance where they believe its not working for them”.

In his first public comments since the rift made headlines, Joyce said: “Our view has been very simple. We’re after fair competition. This means that (airline) companies should be economically independent and not cross-subsidized by a government. “If aviation was governed by the World Trade Organization (WTO), there would be some dumping cases against people for going in well below cost to force people off routes and markets. We think those rules should apply to aviation markets.”

Joyce said Qantas customers won’t lose out if Qatar resigned from oneworld because its pacts with Emirates and Air France/KLM would replace any lost destinations served by Qatar.

“We’ve plenty of alternative mechanisms, which is the way our network is designed. People have a lot of choice on the Qantas-coded network to get to the same European points that they had by using Qatar.”

Whether Qatar does leave oneworld remains to be seen. While the departure of Qatar would be a blow for oneworld, snaring CSA would more than make up for the loss.

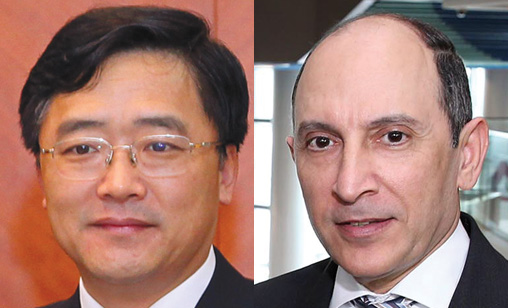

| China Southern and American Airlines deepen codeshare after SkyTeam exit In November, following China Southern Airlines’ long forecast announcement that it would exit the SkyTeam alliance on January 1, the Guangzhou-headquartered carrier signed an agreement with oneworld’s American Airlines to expand their code shares and initiate other business partnerships. The expanded code sharing, expected to be activated early next year, will cover the trunk routes flown between China and U.S. by both airlines, which could be as high as 65 flights per week during peak periods of travel. The two carriers also will introduce reciprocal frequent flyer benefits and lounge access for passengers in 2019. China Southern Air Holding Company Ltd assistant president, Zhang Lin, said: “through sharing resources, our cooperation is market and passenger oriented and based on a win-win relationship.” “With the opening of Beijing Daxing International Airport in 2019, and the ability to cooperate fully with China Southern Airlines, we are incredibly excited about the airline’s future in the Chinese market,” American Airlines president, Robert Isom, said. |