Special Reports: Aircraft Leasing

Lessors on a roll as aviation rebuilds beyond COVID-19

The last two years have been as traumatic for commercial aviation lessors as for their airline customers. But it is generally agreed the sector has remained resilient during the pandemic and played an important role in supporting carriers to the other side of the crisis. Associate editor and chief correspondent, Tom Ballantyne, reports.

June 1st 2022

Right now, Boeing confirms, there are 193 aircraft leasing companies worldwide, up from 117 in 2002. Read More » They are operating in a market valued at $167.8 billion, reports Businesswire, a Berkshire Hathaway company. From this year to 2026, this very large number will reach $247.41 billion, representing an annual growth rate of 7.8%.

These bottom line billions might surprise given lessors are servicing an industry burdened with massive losses and huge debts accumulated from the worst crisis in the life of commercial aviation.

|

The basis for this forecast growth is that most big lessors have worked with their customers, helped them adjust their fleets and negotiated payment deferrals as the COVID crisis has ground on.

Now, as the recovery progresses and airlines rebuild their fleets, mainly with more efficient new generation aircraft, it is forecast leasing will be the best means for carriers to acquire new heavy metal. Leased aircraft in the global fleet, now at 47%, will inevitably continue to rise,

AerCap CEO, Aengus Kelly, who leads the world’s largest aviation lessor, puts it this way: “The pandemic has shown the leasing business is a good business. Well managed lessors with global platforms that are able to move assets around the world and manage the interactions with the customer base and manufacturers during times of great stress have proven the resilience of the aircraft leasing business. It is why we are seeing so much capital interested in the sector.”

Recently, KPMG Ireland analysts quoted Air Lease Corporation (ALC) CEO, John Plueger, when putting forward the reason lessors have proven to be a bastion of capital in this period of COVID-19 crisis. “As evidence of this shift, in 2021 lessors took delivery of 60% of all Boeing and Airbus aircraft orders, all placed under some form of lease, be it sale-leaseback, order book or finance lease. Clearly, the leasing component is a capital star of industry,” he said.

“During this period of airline financial and balance sheet recovery, airlines have looked to leasing in a much more significant way, which I see continuing in 2022 and probably 2023 and beyond.”

|

The KPMG report continued: “Lessors have supported airline customers in myriad ways, from providing aircraft from their order books, enabling airlines to defer their orders without significant penalties and offering combinations of sale-leasebacks and renegotiated leases to assist airline cash flow.”

This optimism about the sector’s prospects is shared by Boeing. Recently, it released its 2022 Commercial Aircraft Financing Market Outlook (CAFMO). It outlined improving financing stability for the industry as it recovers from the pandemic.

“Sale-leaseback deals freed up a lot of capital, which has been great for the industry,” Boeing Capital president, Tim Myers, said. “Lessors have played a tremendously important role, providing support that has benefitted the entire industry. We think there will be a much more balanced recovery going forward.

“A number of new lessors have set up, backed by new private equity and hedge funds, which will strengthen the leasing market. The investment community really likes the lessor models. Investment grade lessors have performed extremely well throughout the pandemic and have put pressure on the rating agencies to upgrade their ratings.

“Overall, the lessor share of the market will stay in that 50% range and continue to be a major player going forward.”

For the second consecutive year, 100% of Boeing deliveries were financed by third parties with the top sources of delivery funding in cash, capital markets and sale leasebacks, CAFMO said.

| "In 2021, the top three sources for paying for aircraft were: cash, or I like to think of it as equity our customers are putting into a transaction, followed by the capital markets and then lease-back transactions. Commercial bank debt for aircraft deliveries does remain constrained but different regions do fund differently" |

| Ben Faires Boeing Capital Markets & Outreach managing director |

Capital markets continue to play a key role in shoring up liquidity for the sector, with the market close to pre-pandemic levels for most issuers as spreads tightened throughout the year.

Boeing predicts export credit supported financing for Boeing aircraft contributed about 5% of total funding last year, primarily from the U.S. Export-Import Bank and also one deal supported by UK Export Finance. The Boeing 2021 Commercial Market Outlook, a separate annual 20-year forecast addressing the market for commercial airplanes and services to 2040, predicts there will be demand for more than 43,500 new airplanes, valued at US$7.2 trillion, in the next two decades.

Boeing Capital Markets & Outreach managing director, Ben Faires, told Orient Aviation: “When you look at 2018 the industry delivered about $126 billion in aircraft”. “When you go to 2020, the number drops to $59 billion. Last year it went up, but it is still about half of the peak level at around $64 billion,” he said.

“To put this in perspective, in 2018 the industry delivered more than 1,700 aircraft. About 80% were narrow-bodies and the remainder wide-bodies. In 2021, airline customers accepted about 1,000 aircraft; 87% were narrow-bodies and 13% wide-bodies. We saw a pretty dramatic reduction in deliveries. This has created a unique environment. There are a lot of players out there looking for transactions and the volumes are not where the industry was pre-pandemic.”

Faires told Orient Aviation: “when we look at the next decade the industry will need about 19,000 aircraft and the majority of those aircraft will be replacing old technology leaving the fleet with new technology coming in.

“In 2020 and 2021, 100% of our deliveries were financed by third parties. It was a testament to the products over the last couple of years, considering the uncertainty in the marketplace, but aircraft financing markets still are very healthy.

“North America has been a very heavy capital market focus,” Faires said. “Historically, the Asia-Pacific has been a very strong bank debt market. Regional banks [in the Asia-Pacific] are supporting their home town airlines. It has been really great to see and has been critical to surviving these challenging times. We see a region in which there is very strong banking support for customers.”

Broad-based bank appetite for aviation leasing continues to be cautionary, with loans extended mainly to stronger credits and strategic customers in their respective home markets. That said, there are signs bank debt availability is improving.

When 2020 arrived; Faires said the sector was “probably as healthy as we have ever seen it”. “That changed pretty quickly. There was a lot of stress, as expected, early in the pandemic,” he said.

“But pretty much across the board we have seen improvement. In 2021 a couple of factors stood out. Leasing activity was very active. Lessors went from early in the pandemic doing a lot of customer workouts and restructuring and then went back to doing their core business and competing for new transactions.

“We observed some very attractive opportunities for airline customers. The capital markets, both in 2020 and 2021, were record years for airlines with more than $120 billion in borrowings.

“The third area was institutional investors. Several sovereign wealth funds, equity funds and different pools of capital interested in aviation started to set up platforms, whether leasing platforms or new debt funds.

“When others pulled back, and primarily I am talking about commercial banks, these [players] came in and filled that void.”

And, as Boeing’s Myers puts it, financiers and investors remain committed to the long-term fundamentals that make aircraft a valuable asset class. “Despite the changing landscape since the outbreak of the pandemic, the industry remains resilient. There continues to be sufficient liquidity in the market for our customers and increasing opportunities as traffic recovers,” he said.

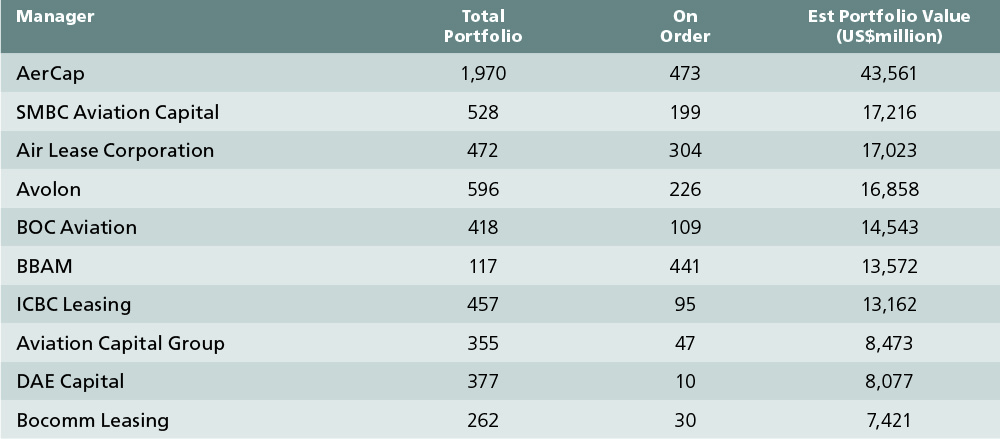

| Top ten aircraft lessors (by portfolio value) |

|

Frank Iso says:

November 10th 2025 07:01am